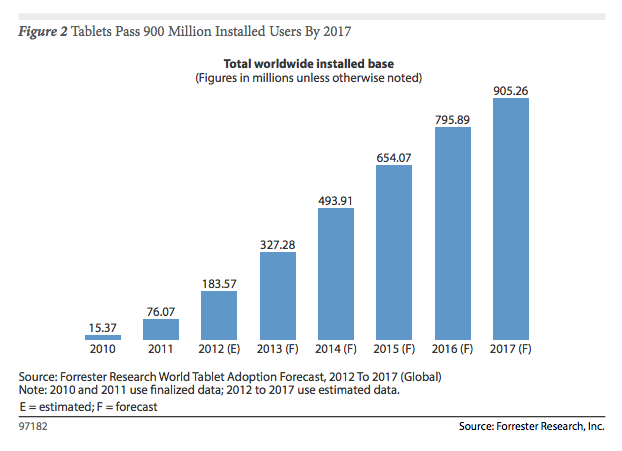

As mobile computing continues to consume the PC’s lunch, a core part of that cannibalisation story is of course the growth in tablet ownership. Analyst Forrester has put out a new forecast for the global tablet market, which predicts tablet sales will continue their rocket-like growth trajectory in the coming years, with a projected compound annual growth rate of 25.6% between 2012 and 2017.

Forrester predicts tablets will exceed a worldwide installed base of 905 million in five years’ time, with annual projected sales of 381.23 million in 2017.

Back in 2010, the year Steve Jobs’ unboxed the first-gen iPad, the global installed base for slates was a mere 15 million+ showing the category has achieved what Forrester dubs “hyper-growth”. The analyst is forecasting more than 327 million tablets will be in use worldwide this year. (Apple’s category leading iPad achieved cumulative sales of more than 140 million as of Q2 2013.)

Tablets represent “the most successful branch” of today’s fragmented computer market, according to Forrester, both by penetration rates and diversity of competition within the category. In the future, it’s expecting tablets to power new types of “collaborative computing” behaviour — involving the use of multiple slates or “tablet-like devices” that support multi-user interaction.

Forrester is predicting that a healthy majority (60%) of online consumers in North America will own a tablet by 2017. In Europe this figure will be lower, at just under half (42%). While in the developing world it expects tablet penetration rates to remain under a quarter (25%) in aggregate by 2017, although it expects certain “wealthier Asian markets” — such as Singapore and South Korea — to feature tablets as established, “universal computing tools” by then.

Tablets at work

The report also delves into what people are using tablets for — vs traditional PCs and smartphones. Use of computing device type varies considerably by location and mobility status, with tablets being most commonly used at home, according to Forrester’s survey (76% of respondents reported using their slates here). The next most popular location for tablets was ‘at the work desk’, cited by 58% of respondents, underlining the important role tablets have carved out in the business space. A further 49% reported using tablets at ‘other room at work’.

“Business applicability shows the full potential of tablets,” notes Forrester in the report. “A comparison of where workers leverage PCs, tablets, and smartphones shows that while PCs rule the desk, tablets rival smartphones in terms of their mobility.”

Fragmentation

The report also notes that the tablet market is fragmenting across a variety of form factors, OSes, connectivity and accessories — something Forrester expects to continue, as it says “buyers don’t hold uniform preferences on tablet sizes”. In other words, it’s horses for courses where slates are concerned.

So, while “many” potential tablet buyers (61% of surveyed consumers) gravitate towards “traditional” tablets (i.e. those with screens between 8.9 to 10.1 inches), Forrester notes that smaller slates (7 to 7.9 inches) have a preference share of around 16%. And very large tablets (10.1 inches+) were of interest to a still relatively sizeable 11%. And a full 12% of surveyed consumers didn’t know which size slate to buy yet.

Turning to tablet OSes, Forrester said it expects Apple to maintain its tablet lead, with iOS and the iPad, but also predicts continued growth for Android, principally from Samsung and Amazon tablet hardware. It also envisages Microsoft Windows-based tablets gaining traction in future — but notes that the apps situation needs “great improvements” before that can happen.

“Forrester believes that Windows will find a foothold in the tablet market but that it will require great improvements in the ecosystem, specifically the number and quality of Modern UI apps, for this to happen,” the report notes.

Collaboration

Looking ahead, the analyst expects tablets to continue to encourage new types of collaborative computing. Possible scenarios include interaction on a TV-sized, single screen, multi-touch supporting tablet-like device — it cites Lenovo’s IdeaCenter Horizon and Microsoft’s PixelSense technology as examples of the kind of tech it’s thinking about here.

It also sees the rise in usage of multiple tablets linked together by collaborative apps, such as Labs’ MindMeld app.

“Using the MindMeld application, [tablet users in multiple, remote locations] join a collaborative workspace that updates in real time during the call. The MindMeld app “listens” to the conversation, surfacing themes and topics word-cloud style. It then leverages an anticipatory computing engine to find relevant content (say, from the Web) that it surfaces on those topics,” the report notes. “These pictures, videos, articles, and other content create a richer conversation as well as a record of the collaborative experience that should drive stronger, more effective, more data-supported collaboration.”

It also expected tablets to play a key role in the rise of smart connected devices such as health tracking kit and home automation devices — as “management console devices”.