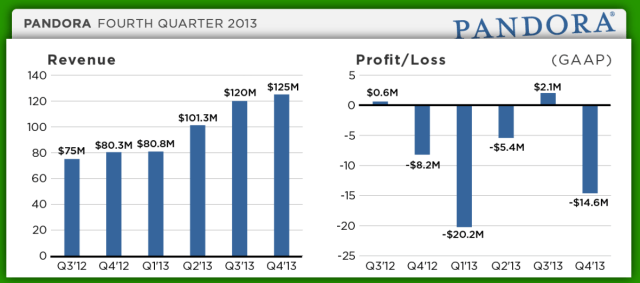

Veteran streaming radio platform Pandora released its fourth quarter earnings today, in which it saw its fiscal 2013 revenue of $427.1 million, representing a 56 percent year-over-year increase, and fourth quarter revenue of $125.1 million, an increase of 54 percent year-over-year. In turn, mobile revenue for the fourth quarter grew 111 percent year-over-year to $80.3 million.

Analysts expected Pandora to report a loss of about 5 cents per share on revenue of $122.7 million for the quarter, compared to a loss of 3 cents per share on revenues of $81.3 million from the same quarter last year. In spite of the expected loss, Wall Street (and the markets) seem to have been viewing Pandora favorably of late, as its stock has increased over 45 percent over the last quarter, and 1 percent on Thursday leading into the report.

On the other hand, it’s been unclear how much Pandora’s recently-imposed limit on free listening hours on mobile devices will affect people’s loyalty and usage of the music service. As Anthony reported two weeks ago, Pandora has had to withstand a lengthy battle against rising royalties and apparently it now feels that harkening back to its old cap on free mobile usage is the best way to fight this — even if it comes at the detriment of the user experience.

This means that those who go over its new 40-hour cap wil have to pay $0.99 to access unlimited listening for the rest of the month, or they can subscribe to Pandora One for $3.99/month to avoid commercials.

Pandora lifted its 40-hour cap on free monthly desktop streaming radio in September 2011, but Pandora CEO Joe Kennedy said recently that the company’s mobile business is now “in a similar position to its desktop business a few years ago — it needs to make more money,” which naturally runs counter to the company’s long-standing mission to offer free music to everyone. This quarter it seems that Pandora is in fact finally starting to monetize mobile in a significant way.

“We continue to monetize mobile at record levels and exceeded our expectations for the quarter,” the Pandora CEO said in a statement today, “and we closed the year with a record 8 percent share of total U.S. radio listening and record mobile monetization.”

Some have expected trouble ahead for Pandora thanks to reports that Apple is planning to launch a competing, ad-supported radio service, which could offer royalty rates at half that of Pandora. Luckily for Pandora, Bloomberg reported today that Apple’s new music service has been delayed until later this year, which, combined with Pandora’s better-than-expected earnings, seems to have contributed to the 19 percent leap in its share price that’s been taking place after-hours.

As you can see in the graphs above, for the fourth quarter, revenue increased 54 percent year-over-year to $125.1 million, with advertising revenue rising 51 percent to $109 million and subscription revenue increasing 74 percent year-over-year to $16.1 million. However, Pandora saw a GAAP net loss per share of $0.09 and non-GAAP net loss per share of $0.04, excluding $6.9 million in stock-based compensation, the company said.

On the other hand, Pandora ended Q4 with $89 million in cash, up from $80.5 million last quarter, and cash generated in operating activities was $8.4 million in Q4, compared to $1.9 million in the fourth quarter last year. Another notable statistic: Total listener hours grew 53 percent to 4.05 billion in Q4 (up from 2.66 billion in the same period last year).

Looking forward, Pandora is setting expectations that it will maintain rather than look to exceed its performance in Q4, forecasting revenue to be in the range of $120 million to $125 million, with non-GAAP loss-per-share between $0.13 and $0.10.

Update:

Not long after we posted this (and Pandora announced its fourth quarter earnings), Pandora President and CEO Joe Kennedy, who has led the company since 2004, will be stepping down. It’s a relatively unexpected news, and the board is now convening a committee to search for Kennedy’s replacement.

Thus, it remains unclear whether the long-time CEO was pushed out or whether he was just ready to move on to something else (or both), but, either way, it marks the end of an era for Pandora — at least metaphorically. As a result, it will also be interesting to see how it makes the transition to its next phase, and whether Tim Westergren (the Pandora founder and Chief Strategy Officer) steps into the role or new blood — and what the market’s reaction will be to the news. Hard to imagine Pandora opening with the same 19 percent hike it found after hours.