The researchers at eMarketer have put out their latest figures on mobile advertising revenue in the U.S., and while they are holding firm on their forecast that they will bring in $2.6 billion this year (it’s a number they actually put out in January 2012), they have drilled down a bit more into who is making what. Unsurprisingly, Google is still at the top of the pile: it will account for 56% of all mobile ad sales. Perhaps more surprisingly, Twitter is doing better than Facebook in driving revenues where mobile ads are concerned: the world’s biggest social network will make half as much as Twitter in mobile ads this year: $72.7 million versus $129.7 million, the analysts say.

However that is bound to be reversed over time: eMarketer predicts that by 2014, Facebook will be making $629.4 million in mobile ads, compared to $444 million for Twitter, putting Facebook at a distant second to Google. Longer term, eMarketer predicts that U.S. mobile advertising will generate sales of $12 billion by 2016.

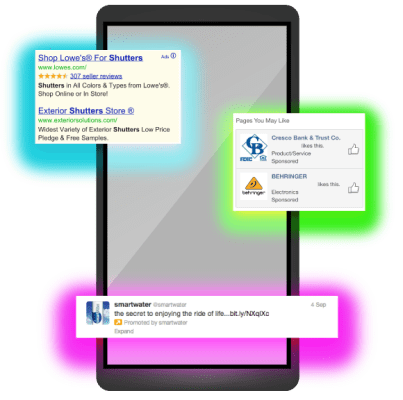

Going back to 2012, the main reason for Facebook’s lower revenues at present, it seems, is the basic fact that it’s not been selling ads on mobile for as long as it has been selling them on main site, accessed via desktop PCs, or for as long as Twitter has on mobile. It was only in August, in fact, that Facebook unveiled its very first non-social mobile ad unit, an option for newsfeed ads that open iOS or Android app store purchase windows when clicked.

Indeed, eMarketer notes that part of the reason that Google, and others like Pandora (at 8.7% of all U.S. mobile ad revenues, 20.5% in display alone), are doing better is simply because they’ve been chipping away at that business for longer.

But it’s not just how long companies have been at the business of mobile ads; eMarketer also notes that some formats just seem better suited to ads than others. In particular, it notes that in Twitter, Promoted Tweets is a natural fit with the “core user experience” of Twitter. Indeed, these ‘ads’ are just seen as part of the flow of the river of information that is one’s Twitter feed. eMarketer notes that Twitter’s CEO Dick Costolo has noted that “on most days” the service actually makes more ad revenues from mobile than on Twitter.com. This might be down to the touch-friendly interface on mobile making these ads more clickable (accidentally or otherwise).

In contrast, Facebook’s primary advertising products on its main desktop platform are on the right-hand side of the screen: these currently make up over 60% of Facebook’s ad revenues, eMarketer says, and these have not made their way into the mobile version of the site. The Newsfeed ads, which are on the mobile version, only started to appear this year.

Meanwhile, Google’s domination is set to continue for years to come. Not only will its overall lead in ads diminish only slightly from its current 54% lead, but as with previous forecasts, the area of mobile search will be a total Google town. Google currently controls 95.4% of mobile search ad revenues, or $1.2 billion of the total $1.28 billion that will be spent this year on mobile search ads in the U.S. (That leaves very little or Microsoft and others.)

The story less monopolized in display ads: here revenues have grown by 102%, helped by the rise of big-screened smartphones, to $1.1 billion in 2012. Rich media ads will be the highest-grossing format within the display category.

Update: As someone has alluded to in the comments below, you should take analyst’s forcasts with a grain of salt — eMarketer’s and others. Some feel even more strongly on this point. I still think it can be instructive to look at all of these comparatively, and notice, for example, how primary sites have been crowding out ad networks like Millennial Media and iAd from the mix, and changing the game in terms of what kinds of ads are working on wireless devices.